Where Will Wall Street Find Their Next Alpha Source?

Investors are always looking for an edge: a source that affords the opportunity to earn excess returns on an investment against a benchmark. This is known as generating “alpha” and it is extremely difficult to do.

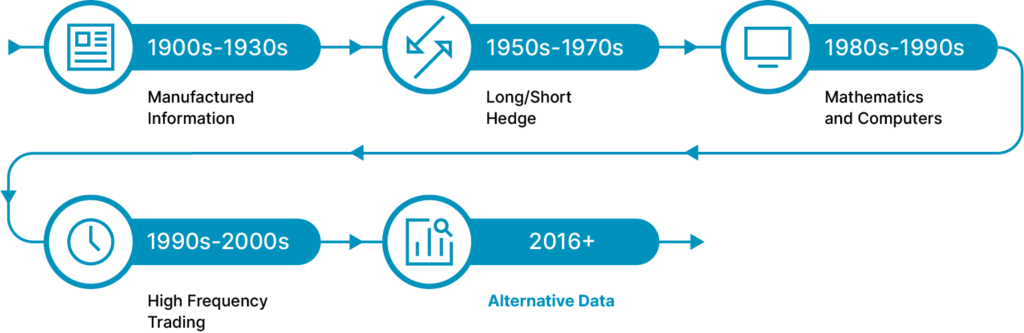

Over the past hundred and fifty years, many alpha sources have come and gone. In the 1950s, it was the invention of long/short equity strategies by the very first hedge funds. In the 1980s, mathematics and computers held an edge over handheld calculators. Then, in the early 2000s, it was high-frequency trading. These were all strategies or tools that, for a time, gave the people who had access to them an advantage over everyone else. But as they became more and more widespread, their advantage dissipated, and investors had to move on to the next thing.

What is Alternative Data?

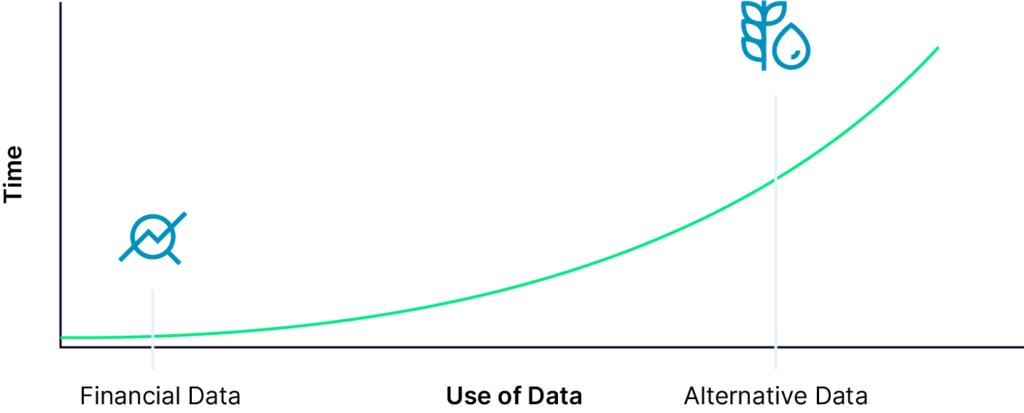

Alpha sources have been lacking in recent years, a fact that is illustrated by lower hedge fund returns over the same period of time. Investors are eagerly searching for new alpha sources.

At the same time, the data economy in which we find ourselves is exploding and the prevailing belief is that the predictive signals buried within the mountains of data we are producing represent the next source of alpha. The future of investing will rely heavily on mining the information that is produced as a result of today’s increasingly digital and connected way of living and doing business.

This is what we call “alternative data” and it refers to unique information content not previously known to financial markets but nonetheless powerful to professional investors. It is not available from traditional market data providers. By 2030, spending on alternative data and its associated infrastructure is expected to near USD 150 billion. An ever-growing number of hedge funds are going “all in” on alternative data, betting that the information advantages it promises will be the primary driver of alpha over the next decade. The data that you produce as a result of your business operations — be it related to logistics, insurance, healthcare, telecommunications, software usage, human resources or other germane topics — is alternative data.

What is the Current Landscape?

The landscape continues to evolve and some early sources of alternative data, such as sentiment data and satellite data, have already become almost as commonplace as stock price history and fundamentals. It is no surprise, then, that banks and asset managers are ravenous for new data assets. They must keep trying to find that edge.

Organizations are now queuing up to pay tens of thousands of dollars for untapped data, including data you might already have.

How to Seize the Opportunity

If you believe you’re sitting on valuable data and you now understand that investors are potentially interested in buying it, what’s next? To start, you need to understand the key considerations for getting your data into their hands.

When we talk about “Wall Street”, what we mean is anyone on the “buy-side” of capital markets — those who invest in stocks and bonds on behalf of others. They could be on Wall Street or elsewhere — but we find the vast majority of early adopters in this space are in New York.

On the buy-side, hedge funds are the most aggressive players in terms of their willingness to seek excess returns, or alpha. Furthermore, among the hedge fund ecosystem lives a type of fund that is exceedingly sophisticated in its use of data: the quantitative hedge fund. This is your best potential customer. You can think of them as alpha hunters. To deliver on the bold promises they make to their investors, quantitative hedge funds will invest heavily in data.

That is not to say that other buy-side investors won’t purchase data, but the quants are a good place to start. However, this is not an industry where you can cold call an asset manager and suggest selling them FTP access to your data. These professionals are notoriously difficult to reach. More importantly, there is a lot more that goes into selling an investor a data asset.

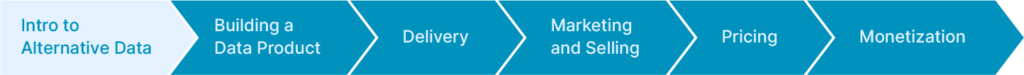

Up Next: Building a Data Product

If you want Wall Street to take notice of your data, you’ll need to productize, have the infrastructure to reliably deliver your data, and get an “in” with this crowd to get them to look at your data in the first place.

Stay tuned for Nasdaq Data Link’s next installment of Turning Raw Data into Wall Street Gold with Part 2: Building a Data Product