This is a preview of the Corporate Hotel Bookings White Paper published by Nasdaq’s Alternative Data Research Team. If you’d like to read the full paper, download it here.

Forecasting the performance of a business segment

Imagine having a daily window into where business professionals are booking, at what rates, under which brands, and if they’ve cancelled before check-in. Nasdaq’s Corporate Hotel Bookings (CHB) paints a comprehensive picture of the corporate booking landscape, with the ability to map the performance of major hotel chains and even forecast future trends in hotel rates.

Unlocking Insights with Cohorting

Corporate Hotel Bookings is powerful in measuring the performance of the business transient segment of hotel chains; however, care must be taken to accurately measure performance. An effective method is through “cohorting”, which involves comparing period growth rates, such as year-over-year or quarter-over-quarter, by ensuring a direct comparison of similar groups or segments. By comparing “apples with apples,” cohorting allows for a more accurate assessment of performance over time.

Hotel companies commonly refrain from providing detailed statistics on the performance of their business customer segment. Instead, they tend to offer generalized statements, such as indicating that the business segment has “reached pre-pandemic levels”.

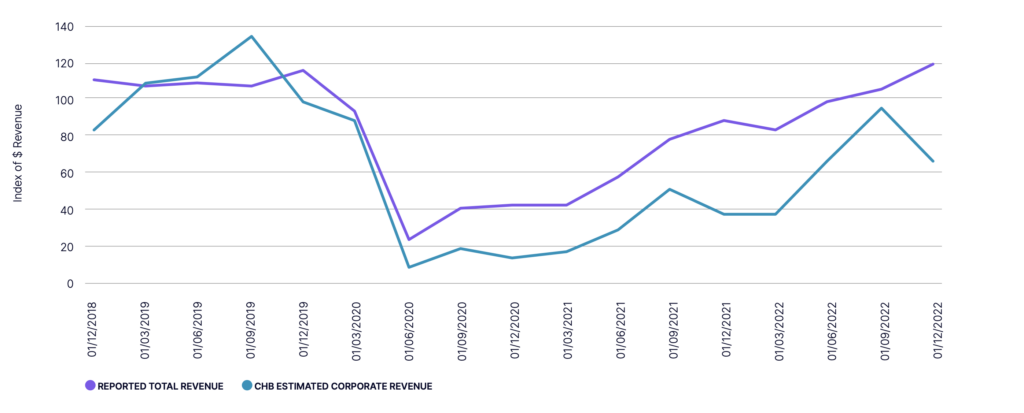

The advantage of Corporate Hotel Bookings is that subscribers can use cohorting techniques to gain a comprehensive understanding of how corporate hotel spending is behaving. The graph below depicts Hilton’s reported total revenue as above its pre-pandemic level. However, by using the CHB dataset and the cohorting technique, it is evident that the decline in revenue was much steeper, and they have yet to recover to pre-pandemic levels.

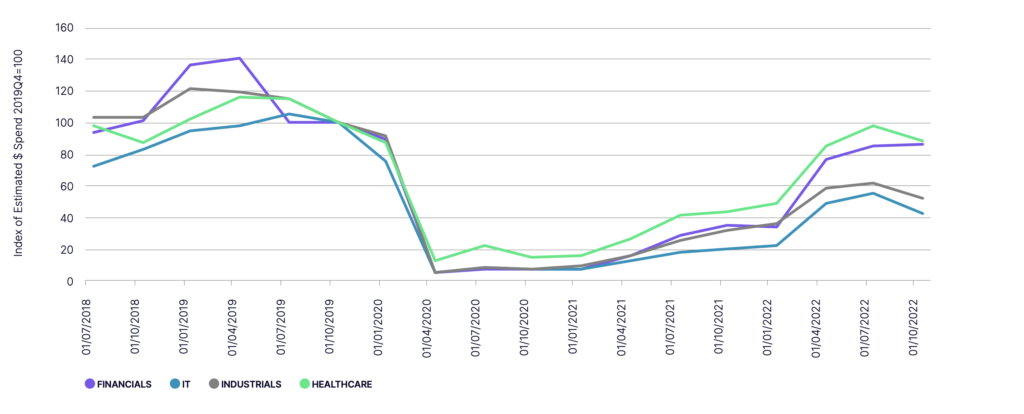

In addition to using cohorting for measuring the performance of the business transient segment within a hotel company, it can also be used to assess whether companies in specific sectors of the economy are booking more or fewer hotels. Below, we can see that that some sectors, such as Financials and Health Care, are booking hotels similar to pre-pandemic levels, but others, such as Industrials (which, in CHB, includes consultants) and Information Technology, are still well below their pre-pandemic levels.

Want to Continue Reading?

This is a preview of the Corporate Hotel Bookings White Paper published by Nasdaq’s Alternative Data Research Team.