Acquiring data to navigate the numerous U.S equities markets can be overwhelming. Despite dedicating significant resources to gather market data, organizations that need total market coverage often struggle to manage various data sources.

Excitingly, we are partnering with industry leaders like OTC Markets to bring transparent and effortless data access, all consolidated in one convenient location. With the recent addition of OTC Markets data on Nasdaq Data Link, you can now obtain complete coverage of all U.S. equity markets in one place and receive via flexible API delivery.

Here’s How

Create a free account on Nasdaq Data Link so you can access our API, data catalogue, and tools.

Which Feeds Should I Use?

Subscribe to our flagship product, Nasdaq Basic, alongside OTC Markets data, to can gain real-time insights into 27,000+ listed and OTC securities.

What is Nasdaq Basic?

Nasdaq Basic is the leading exchange–provided alternative for real-time Best Bid and Offer and Last Sale information. With Basic, investors access a proprietary data product that provides accuracy, liquidity, instrument coverage, and accessibility with significant cost-savings.

With coverage of all U.S. exchange-listed stocks, it serves as the single largest liquidity pool for U.S. equities, every day.*

*Based on liquidity within the Nasdaq Market Center, as well as trades reported to the FINRA Trade Reporting Facility® (TRF®) operated in partnership with FINRA/Nasdaq TRF®

What is OTC Markets Data?

OTC Markets Group operates the primary U.S. Over-The-Counter equity market and provides price and liquidity information for more than 12,000 securities on the OTCQX, OTCQB, and Pink Markets. The normalized OTC Markets data feed on Nasdaq Data Link platform offers trades and Inside Quote (BBO) and reference data for OTC securities.

In the first half of 2023, $180 Billion was traded in 12,000 OTC Markets securities.

Key Benefits

Access the Entire U.S Equities Market + More

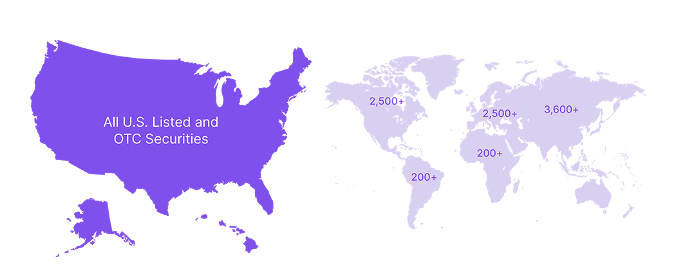

By combining Nasdaq Basic and OTC Markets data feeds, you gain coverage of all listed and OTC equity securities in the U.S, which includes more than 9,000 international securities such as Tencent (TCEHY), exchange delists, and alternative investments like the Bitcoin Trust (GBTC).

The Most Liquidity, Everyday

Nasdaq and OTC Markets’ trading venues have the largest traded volume in the listed and U.S OTC equity markets respectively, meaning you can base your decisions on data that is highly reflective of the market at any point in time.

Ease of Use

To effectively execute strategies, it’s easier to avoid technical complexity. Nasdaq Basic and OTC Markets data are delivered via a cloud normalized cloud format for easy integration into firms’ and broker-dealers’ existing processes.

Cloud-Based API Delivery

This data combination is made conveniently accessible via Nasdaq Data Link, providing efficient delivery via cloud-based APIs.

Ready to unlock real-time data on 27,000+ securities?

Subscribe to our flagship product, Nasdaq Basic, alongside OTC Markets data.